New car prices have reached record highs, with the average new car selling for above MSRP, and the average new car price cresting $44,000. For car buyers on a budget, buying a used car used to be an attractive alternative,. But with used car supply down we've seen their prices increase over 30 percent in the past year, with the average used car now costing more than $34,000.

Beyond the recent price hikes, some consumers are wary of buying a used vehicle because of the uncertainty of the vehicle’s history and the difficulty of the buying process. However, being a well-informed shopper can help you navigate the used car buying process and find the right car at the right price.

We'll discuss each step of the used car buying process below, but the process involves a lot of terms you may not be familiar with. We'll explain them as we go, but if you're looking for a comprehensive guide to car-buying terms you can also browse our Car Terms glossary to see a detailed definition:

1. Set Your Used Car Budget

While used cars are cheaper than new cars, they are still a major expense. That’s why it’s important for car buyers to set a realistic budget and determine how much you want to pay for your used vehicle. You don’t want to go through the trouble of finding your ideal car only to learn that it’s more expensive than what you can comfortably afford. Setting a budget will also provide a clear starting point for your used car search. If you plan on financing, examine your monthly expenses to see how much money you can spend on a car payment. It’s wise to pay as high of a monthly payment as you can afford in order to shorten the term of your loan and save on interest. One helpful rule of thumb is that your car payment and related car expenses such as gas and insurance should not exceed 15 percent of your monthly take-home pay. If you plan on paying cash, determine how much money you are willing to put down. If you’re trading in a vehicle, do your research to see how much you will get for your trade-in, as this will go toward your down payment. Be familiar with your car’s Kelley Blue Book value and understand how much similar used cars sell for so you can determine if the valuation is fair.2. Beware Of Extra Costs

Make sure that you budget for more than the advertised price of the car. While each state has different taxes and associated fees, you can expect to pay an extra 10% on top of the purchase price to cover all costs. If you’re financing the vehicle, it’s important to understand that you’ll also be paying interest on the financed portion of the vehicle. You should also research the car’s ownership costs. Insurance is a big part of these, and it will cost more on later-model used vehicles. Talk to your insurance agent before you purchase the vehicle to get an idea of what your new rate will be. Be aware that used car insurance rates are also higher on sports cars and performance vehicles. You can also shop around with other insurance companies to ensure you’re getting the best rate. If you’re purchasing an SUV or a less fuel-efficient vehicle, you should also factor in additional fuel costs to make sure there is room in your budget. (Check out our list of Best Gas Mileage Cars to help reduce your fuel costs.)3. Weigh Your Financing Options

You should always go to a bank or credit union to get pre-approved for a loan before you go to the dealership. You might get pre-approved for a higher amount than what you can comfortably afford, so make sure you stick to your budget. Even if you plan on securing an auto loan through the dealer, having a pre-approval option from a financial institution can help you negotiate against the dealer’s rate. Because dealers make more money on vehicles they finance, they are likely to try to beat the rate’s you’ve already secured and beat their rate. It’s important to note that most banks will not provide a loan on a vehicle that is more than five years old, so if you are relying on financing, you should consider newer used vehicles. Be aware that your credit score directly impacts your interest rate, and having aso you should try to have your credit score above a 680 will make a substantial difference. If you don’t have favorable credit, you should do your best to repair it before you purchase a vehicle.When selecting the terms of your car loan, you should take out a loan for as short a term as possible. While stretching it out can provide you with lower monthly payments, you’ll also be paying a higher interest rate. For example, if you purchase a $25,000 used car and put $4,000 down with an interest rate of 4.5 percent, your monthly payment will be roughly $625 and you will pay $1,488 in interest over the duration of the car loan. If you spread the loan out over five years with a higher interest rate of 5 percent, you will pay roughly $396 per month and $2,778 in total interest. While a smaller monthly payment might seem appealing, it will cost you a lot more in the long run.

4. Anticipate Your Ownership Needs

Before you begin your used car buying process, you should determine your ownership needs to help ensure you make the right vehicle purchase. Some important things to consider include- Why are you buying a car? Do you need a spacious family hauler or a fuel-efficient car for commuting?

- How long do you plan on keeping the car? If longevity is important to you, you should consider vehicles that have proven to be among the longest-lasting cars.

- How important is fuel efficiency to you? Should you consider a hybrid or electric vehicle to cut down on fuel costs?

- What kind of features are most important to you? Do you want the latest safety features like automatic braking and lane departure warning? Or comforts like ventilated seats or a heated steering wheel?

5. Know the Best Time to Buy

If your situation allows, you should be aware that certain times of the year are more likely to result in savings on a used car. The best time to buy a used car is at the end of the year in November and December due to a high volume of trade-ins as buyers take advantage of end-of-year sales and incentives. This is also after new model year vehicles come out, so dealers want to move their older inventory to make room on their car lots. Holiday weekends such as Thanksgiving and Veterans Day provide a lot of savings opportunities. However, just because more deals can typically be found during this time of year, you can still find great deals all year round. You might just have to spend additional time finding them.6. Research Cars Online

Helpful used car websites and search engines have made it easier and more convenient than ever to find the right used car. Used car search engine iSeeCars.com uses data to objectively rank millions of cars and thousands of dealers, providing helpful insights and guidance to car buyers to find a good car at a good price from a trustworthy seller. Other popular sites include Autotrader, Cars.com, and AutoTempest. Used car search engines and research sites allow you to easily compare prices and features like warranties, vehicle histories, and condition. Doing some research online will help limit the number of dealerships you have to visit and will allow you to better streamline your search.7. Go Window Shopping

If you’re unsure what kind of vehicle you’re interested in, visit one or more local dealerships to research different makes and models to guide your decision. Even if you think you know which specific car you want, you should still investigate competitors to confirm your choice. Using this approach to narrow down your car search will simplify your next steps in the buying process. By focusing on a few models you can begin researching the different trims and model years of these vehicles to see which used car is right for you.8. Decide to Buy From a Dealer or Private Seller

When you’re shopping for a used car, you have the option of buying a car through a dealer or through a private party. Private sellers can be found on car search engines or through sites like Craigslist. Here are some pros and cons of each:Car Dealership Pros

- Dealers Take Care of The Paperwork: If you buy from a dealership, they will handle all the paperwork. This includes the title transfer, the bill of sale, and the registration.

- Easy Financing: Dealerships have a finance department that allows you to get an auto loan directly through the dealer. You can also get a loan through a bank or credit union, which you should arrange before visiting any dealership. Assuming the dealer can match or beat your own financing option, going through the dealer will save you some time and paperwork.

- Warranty Options: Dealerships provide the option to purchase an extended warranty for added peace of mind, though you should research the dealer’s warranty options carefully and confirm the terms meet your expectations. (Refer to our handy article: Are Extended Warranties Worth It? For more information.)

- They Handle Your Trade-In: If you are trading in a vehicle, a dealership will take care of all the related paperwork and apply your trade-in’s value toward the down payment of the vehicle you’re buying. Just make sure you do your research so you can get the best price for your trade-in vehicle.

- Higher Prices: When comparing prices of dealerships and private sellers, dealers are likely to have a higher price. This is because of the overhead they have to pay, including employee salaries and the space of their showroom and lot. Dealers are profit-driven, particularly on used car sales, so they will have higher prices to cover their costs.

- Commissioned Salespeople: It’s no surprise that car salespeople work on commission. They may pull out all the stops to try to get you to buy a vehicle, which can be an uncomfortable process, especially if you want to negotiate a lower price or decide not to buy.

- Unnecessary Extras: Dealers make a large profit on any “extra” items they can bundle with a car sale, and they will likely pressure used car shoppers to purchase these items. Examples include extended warranties, maintenance plans, or paint and interior cleaning treatments. Make sure you really want or need these items, and negotiate the price down if you buy them.

- Lower Prices: Private sellers can sell their car for a lower price because they don’t have the overhead of a car dealership.

- Room for Negotiation: While some used car dealers have a “no-haggle” pricing model, you can often negotiate with a private seller. They might be in a rush to sell their car so they can purchase a new one and might accept a lower offer as a result.

- No Warranty: Private sellers typically sell their car “as is.” If you have any issues after you purchase the car, you likely can’t take it back.

- Lack of Accountability: Private used car sellers aren’t subject to regulations, which means you aren’t protected if you purchase a lemon. They also don’t rely on word-of-mouth and online reviews like dealerships, so they aren’t subject to the same repercussions if they scam a buyer.

- They Don’t Handle Vehicle Registration and Other Paperwork: Unlike the dealership, you need to visit the DMV to process the registration and title transfer.

9. Shop Around

It’s important you provide yourself with several options when buying a used car. You might have your heart set on just one vehicle, only to find a potential problem or learn that it’s already been sold. If you can be flexible in which vehicle you want and what features it has, including color and options, that will expand your used car choices and increase your leverage when it’s time to negotiate a deal. Once you’ve located at least three or more likely cars that fit your needs and budget, ask the dealers or private sellers to tell you more about each car and schedule appointments for a test drive. Let them know you are looking at other used vehicles so they know you have additional options10. Find a Reputable Dealer

iSeeCars

11. Get a Vehicle History Report and Conduct a VIN check.

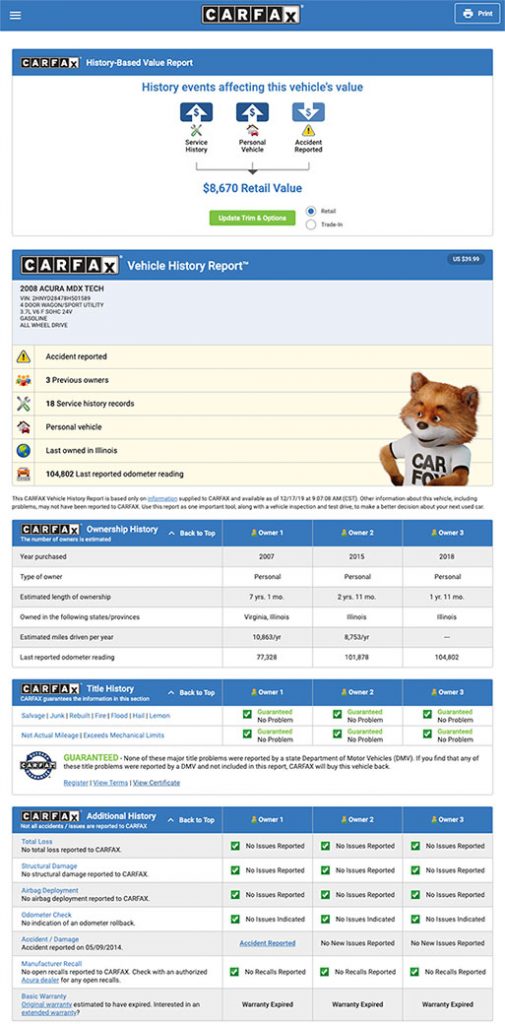

Knowing a vehicle’s history can help you anticipate issues you may have in the future. That’s why it’s important to ask the dealer for a car’s vehicle history report. A history report such as CARFAX or AutoCheck will provide important information about a vehicle’s past, like if it's been in an accident, its number of previous owners, maintenance records, and if it has a salvage or flood title. Understanding a used vehicle’s history will help shoppers determine the condition of the vehicle when deciding if it’s a smart purchase.

Going through a car dealer isn’t the only way to obtain a vehicle history report. Online research tools like the iSeeCars VIN report can provide a free CARFAX report as part of its comprehensive VIN check tool. While a vehicle history report is critically important, it gives just some of the relevant information about a used car. A comprehensive VIN report will complement the vehicle history report to provide all the important information a shopper should know before making a used car purchase.

So what is a VIN check and how do you perform one? The seller of the vehicle should be able to provide you with the vehicle identification number (VIN) from the car title or from the dashboard or door jam area. Checking the VIN through the iSeeCars VIN Report will provide a comprehensive analysis to answer all the important questions car shoppers should ask before making their purchase. You can download the VIN Report App, which will allow you to scan a vehicle’s VIN and get instant access to the report. The VIN check will provide:

- Pricing – Calculates the car’s fair value based on the local market and maps similar cars for sale locally.

- Selling History – Provides records of price changes and where the car was previously listed and sold.

- Condition – Analysis of mileage on the odometer, positives and negatives about the vehicle’s features and condition, and other resources like theft record, recalls.

- Dealer Scorecard – Compares dealers’ price competitiveness, responsiveness, and transparency.

- Depreciation – Estimates how much the car will depreciate over 1, 3, and 5 years

- Supply Analysis –Identifies similar vehicles for sale within the local area.

- Best Time to Buy – Analyzes when or what months may get you a better price.

- Theft Record – Checks if a vehicle has been reported as stolen on the National Insurance Crime Bureau (NICB) database.

- Free Recall Check – Checks if there are any open recalls that haven’t been fixed and notifies of any past recalls.

- Title/Lien Info – Provides title/lien information depending on the state DMV. (For more information on branded titles, check out our handy guides on salvage titles and rebuilt titles.)

- Vehicle History - Free CARFAX or Autocheck reports when provided by the seller.

12. How Many Miles is Too Many?

Mileage should be considered as one important factor among many important factors when purchasing a used car. You should be wary of a newer car that has accumulated mileage far beyond the national yearly average of 12,000-15,000 miles a year. You may be able to buy a high-mileage hauler for cheaper, but that means you’ll likely end up servicing parts like brakes and timing belts. When considering how many miles a used car should have , you should typically buy the newest car and most reliable ca r that fits your budget.13. Consider a Certified Pre-Owned Car

If you are purchasing through a franchise dealer, meaning a dealer that officially represents a vehicle brand, you will have the option to buy a manufacturer certified pre-owned (CPO) car. But, What does certified pre-owned mean exactly? CPO cars are typically late model cars that have recently completed a lease term or have been used as a loaner vehicle. To qualify as a CPO vehicle, it usually must be under 5 years old and have less than 75,000 miles on the odometer. However, this will vary by manufacturer. CPO cars provide the best of both worlds by having approximately the same price of a used car (they usually cost a bit more) and the peace of mind of a new car thanks to a comprehensive warranty and special financing offers. CPO cars can even provide added perks, such as roadside assistance. These vehicles can only be found at their own franchised dealer lots. For example, you won’t find a manufacturer certified Honda at a Toyota dealer.It’s worth noting that non-manufacturer-backed (non-CPO) warranties are also available for most used cars, but these are not as comprehensive or easy to use as CPO warranties. These low-tier warranties may require you to pay for all repairs up front and then get reimbursed later, which can take time and even be denied by the warranty company. Always confirm a warranty is “manufacturer backed” before buying a used car. If it’s not, look closely at the terms and consider buying a CPO car instead if the warranty doesn’t provide the level protection you’re looking for.

The downside to CPO vehicles is that they are more expensive than non-certified used cars. However, some cars tend to have lower CPO premiums than others. To see if it's worth buying a CPO vehicle, you should check out the car’s predicted reliability rating to determine future repair costs. You can then outweigh those costs with the higher price that comes with purchasing a CPO car. One thing worth noting is that CPO cars can often be leased, which car buyers may not be aware of. If you’re interested in leasing a car and want to lower your monthly payments or upgrade to a more expensive vehicle, a used car lease might be a smart decision. Check out or Can You Lease a Used Car or our Leasing Vs. Buying a Car: guides to learn more.

14. Thoroughly Inspect the Used Vehicle

You can conduct your own inspection when you see a used vehicle for the first time. You should be able to catch any glaring problems, like rust, mismatched paint colors, and cracks or leaks under the hood. Also keep an eye out for signs of poor alignment, like uneven tire wear. This could indicate a problem with the suspension. If the vehicle passes your first examination, take it for a test drive and bring it to a trusted mechanic for a more thorough examination to ensure it's in good condition.

15. Make the Most of Your Test Drive

Never buy a used car before taking it for a thorough test drive to confirm it’s the right car for you. Since you will be spending so much time in your car, it’s important you enjoy being behind the wheel. A test drive is also your opportunity to make sure there are no immediate or developing defects that will become your problem after you buy the car.In order to make the most of your test drive you should select a route that has the same driving conditions you will be experiencing after the purchase. You should also keep the radio off (except to test that it works and sounds fine) and limit your discussion with anyone in the car so you can focus on the vehicle and hear the noises the car makes. A useful blend of driving conditions would include neighborhood driving, rough pavement, hills, tight curves, and a stretch of highway use.

As you are taking the test drive, pay attention to vehicle feedback that will make it easier to diagnose any potential problems or issues a car might have. Examples include vibrations at highway speeds, confidence and stability in tight turns, smooth ride quality, a consistent pull to the left or right, and any noises that don’t make sense. Specific items to focus on during the test drive:

- Visibility: Do blind spots prevent you from safely driving the vehicle?

- Acceleration: Do you feel the car has enough power?

- Brakes: Are you able to break easily and confidently?

- User-friendliness: Do you feel comfortable with the primary controls and infotainment system?

- Steering: Are you able to easily and comfortably navigate turns How does the steering feel through corners?

- Are there noises or vibrations?: Make sure you listen for any unusual noises or vibrations.

16. Get An Inspection

Along with your own inspection, it’s important to get the car inspected by a trusted professional before you purchase. While a pre-purchase inspection can cost you $100-$200, it is a wise investment and can end up saving you a lot of money in the long run. It can also provide you with peace of mind that is well worth the added cost. If you’re buying a certified pre-owned vehicle, an inspection isn’t necessary because the vehicle has already undergone a rigorous inspection and is covered by a warranty.An inspection doesn’t guarantee a trouble-free ownership experience, but it can uncover many potential problems and let you know if a vehicle has been in an accident. Some accidents go unreported to insurance companies and will not show up on vehicle history reports, but an experienced mechanic will be able to tell if any body or frame work has been performed due to an accident.

17. Negotiate

As with new cars, the sticker price is the dealer’s asking price. Unless the seller has a no-haggle price guarantee, you can probably purchase the car for less if you know how to negotiate. Let the seller know you are still shopping for other vehicles and you will walk away from the deal if they don’t meet your terms. If you think the price is fair based on your research of comparable vehicles, you can give them a bid of $500-1,000 below asking price. Let them know that you’ve done your research and you think this is a fair price. The worst they can do is say “no,” and you will still be able to accept the original asking price. The seller may take your price—or at least provide a counter-offer that’s still lower than the asking price to get the car sold. If you’re buying from a dealer and they can’t bring the price down on the car, they may be able to provide you with more money on your trade in.As mentioned above, be vigilant throughout the negotiation and purchase process. Don’t assume an agreed price means the deal is over. When buying from a private part make sure you get everything that goes with the car (owner’s manual, receipts, car cover, etc.). When buying from a dealer, watch for unnecessary add-ons and inspect every line of the purchase contract. If you have any questions around costs ask the dealer to explain them, and if you’re not comfortable for any reason simply walk away.

Remember, there are plenty of used cars in the world and you can find another one if necessary. A willingness to walk away is your strongest leverage point when buying a used car. Don’t forget to use it if the deal doesn’t feel right.

Ready to begin your used car search? The iSeeCars.com used car search engine is the perfect place to start. With millions of listings that rank the best deals first and 59 user-friendly search filters, it can help you find the best at the best price. And be sure to check out the comprehensive iSeeCars VIN check report to further help guide you through the used car buying process and help you get the best deal possible.